Apartment vs Officetel

In Korea, there are various types of residential properties such as apartments, officetels, detached houses, villas, and multi-unit houses.

Koreans have traditionally preferred apartments as their primary choice of housing, and this trend has become even stronger in recent years.

Following apartments, officetels are the next preferred option. They are often chosen by households with two or fewer members or those prioritizing accessibility to workplaces or city centers.

Apartments and officetels are also popular choices among foreigners. This preference is because the larger apartment complexes offer the sense of stability and because many officetels are located in downtown areas, providing excellent transportation accessibility and proximity to commercial districts.

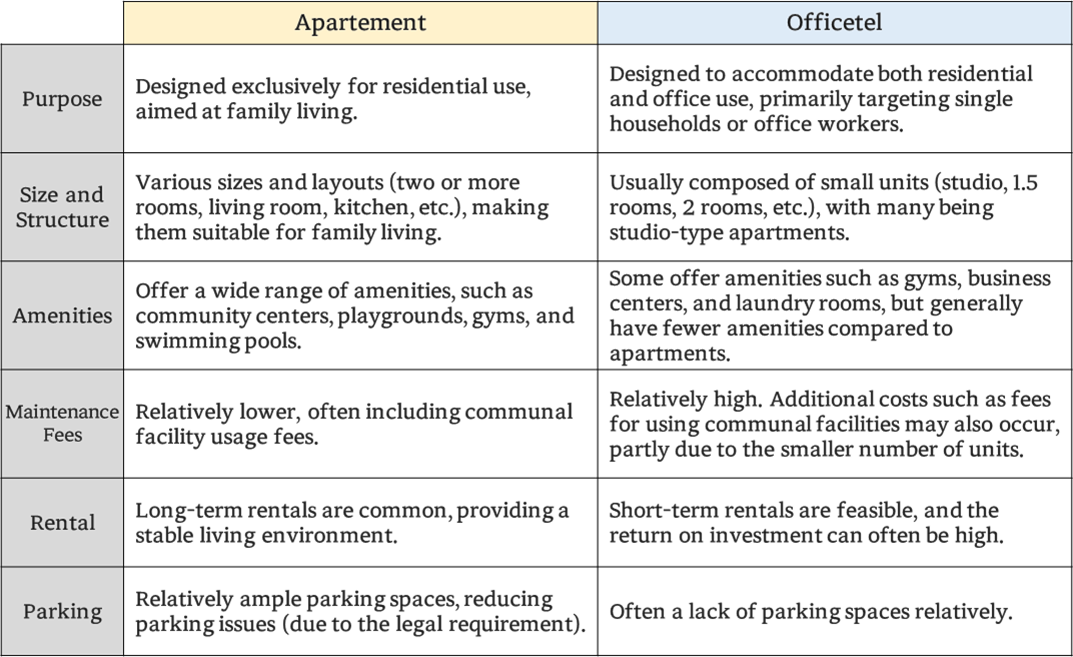

“What are the differences between apartments and officetels?

The most significant difference between apartments and officetels is that officetels offer the option to use them for both commercial and residential purposes. Let's explore the overall differences.

• Basic Differences

Another important difference lies in tax-related matters such as acquisition tax and property tax. Generally, officetels tend to have slightly higher taxes, but there are various factors such as not being included in the housing count when purchased for commercial purposes.

Since tax considerations involve numerous individual factors, it is advisable to seek detailed consultation to understand them thoroughly.

• Tax Differences

Taxes related to real estate are very complex and require thorough review. Like the rest of the world, Korea saw a significant rise in real estate asset prices due to the liquidity injected during the COVID-19 pandemic. As a result, numerous regulatory policies were implemented to curb this rise. Recently, there have been political movements to lift these regulations, so tax policies are subject to change at any time.

'부동산 이야기(Real Estate Story) > Real Estate Study(for Foreigners)' 카테고리의 다른 글

| Korean Real Estate - What is the Jeonse System? (1) | 2024.11.19 |

|---|---|

| Info. about Major Residential Area in Seoul - Jongno (0) | 2024.07.10 |

| Brief Guide to Seoul from a Realty Perspective (Part. 1) (0) | 2024.05.28 |